Navigating the Unpredictable World of High-Frequency Trading

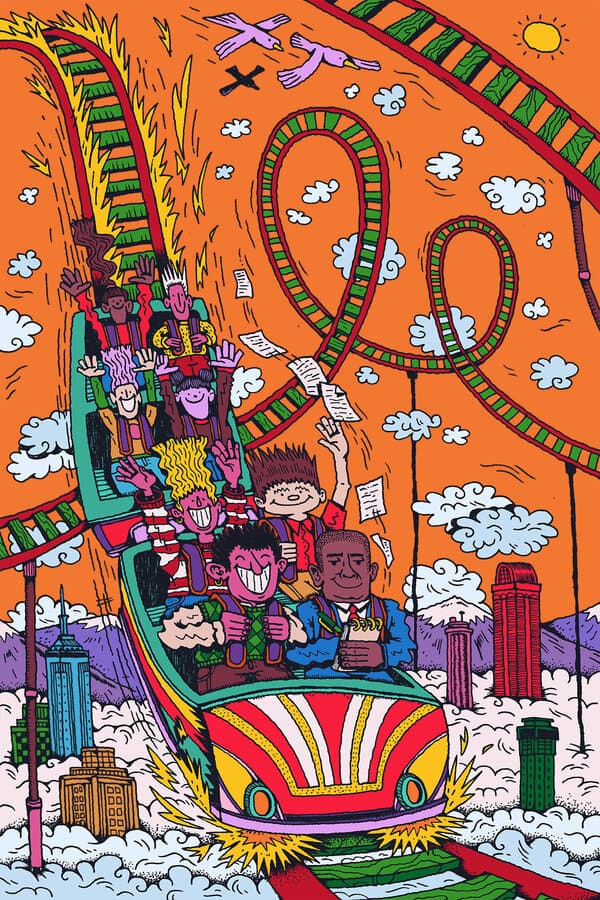

The world of high-frequency trading operates at a blistering pace, where fortunes are made and lost in the blink of an eye. This complex ecosystem relies on sophisticated algorithms and ultra-fast connections to execute trades in microseconds. Traders in this arena are constantly racing against time, exploiting minute price discrepancies across various markets. The environment is often compared to a roller coaster, filled with exhilarating highs and stomach-churning lows. Firms invest heavily in technology, from fiber-optic cables to microwave networks, to shave off precious milliseconds from trade execution times. This technological arms race has fundamentally reshaped financial markets, increasing liquidity but also raising concerns about stability. The sheer speed of these transactions can amplify market volatility, leading to flash crashes that happen faster than human regulators can react. Participants must manage immense stress, knowing that a single coding error or system glitch can lead to catastrophic losses. Despite the risks, the allure of substantial profits continues to draw new players into this high-stakes field. Regulators worldwide are grappling with how to oversee these algorithmic behemoths without stifling innovation. The debate continues over whether this form of trading provides a net benefit to the market or merely introduces unnecessary risk. Understanding this dynamic sector requires looking beyond the surface of rapid-fire transactions and into the underlying mechanics driving modern finance. The narrative of high-frequency trading is one of innovation, risk, and the relentless pursuit of speed, painting a vivid picture of contemporary market dynamics. As technology evolves, so too does the landscape of this digital battleground, ensuring that the roller coaster ride is far from over. The human element, though often overshadowed by machines, remains crucial in designing strategies and managing the ethical implications of this automated trading dominance.